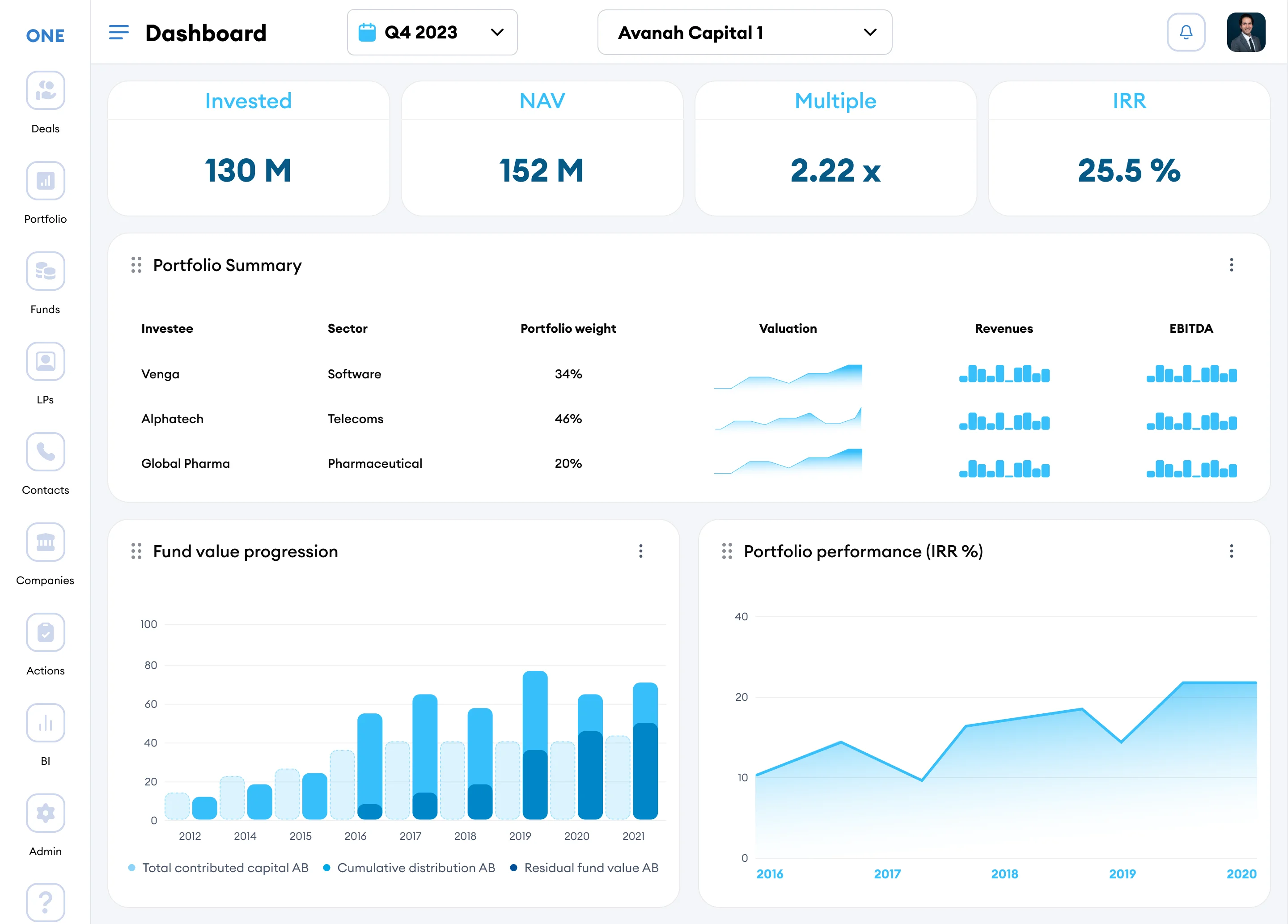

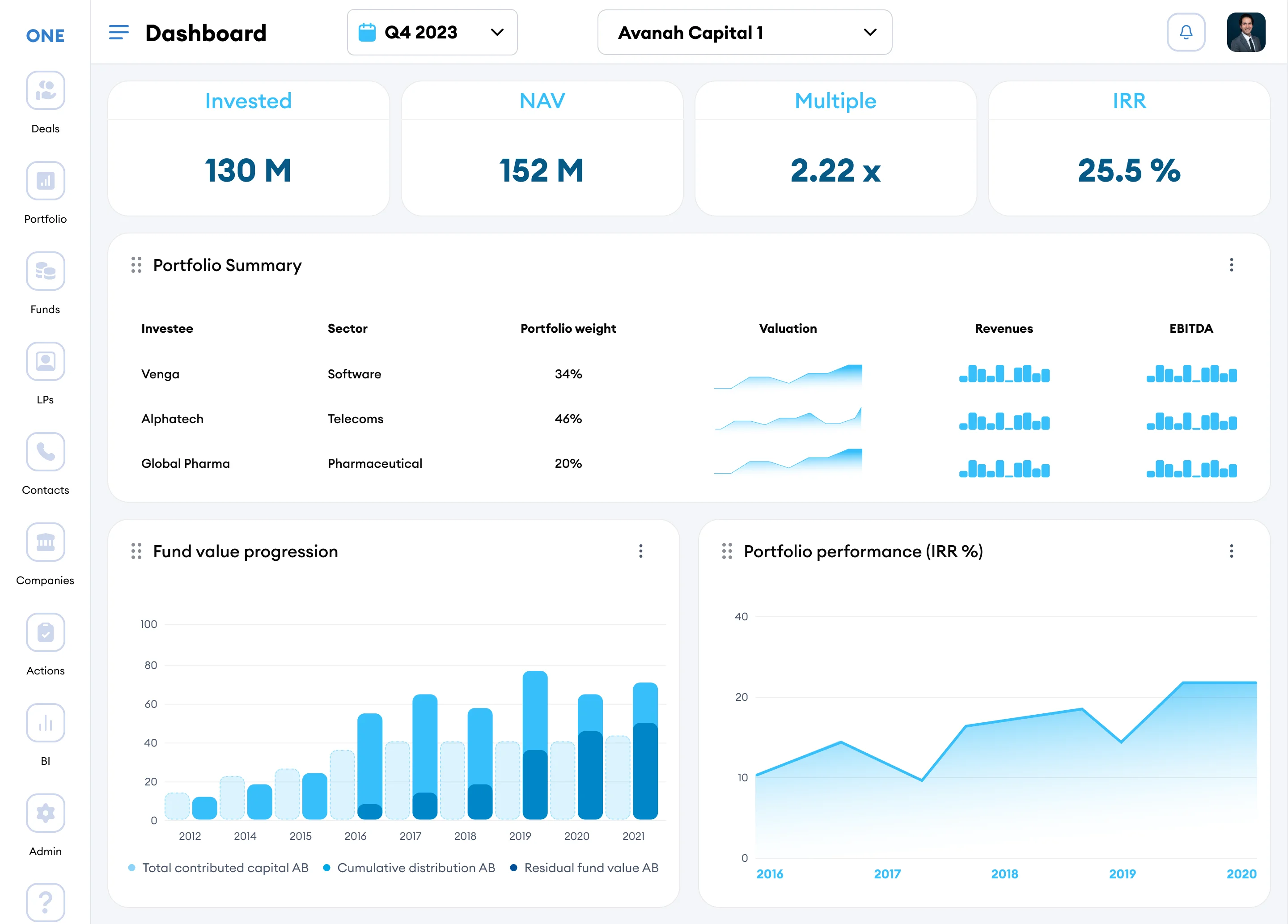

Fully integrated Private Equity software.

Let's scale your AUM together.

Faster.

Traditional Private Equity software is outdated, slow, and inflexible. DAVIGOLD is transforming the industry with ONE - an all-in-one, cutting-edge suite built for General Partners, Limited Partners, Asset Servicers, and PE Retail platforms.

From Portfolio Management and Fund Administration to Investor Servicing and advanced Reporting automation, our technology empowers PE professionals to scale AUM, streamline Investor Relations, and generate unlimited reports in seconds.

Request a demo

DAVIGOLD is the driving force behind the fund management of elite Private Equity players, such as:

LPs engage with our investor portal.

managed within our software.

Customized and automated by our clients, with a single click.

revenue growth in 2025.